Table of Content

There must also be a separate date for when you should contact your bank when you havent obtained your refund by then. If you filed a proper return on time and the IRS does not issue your refund inside forty five days after accepting it, the company is required to begin paying interest on your refund amount. For electronically filed returns, please wait as much as 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to eight weeks. For copies of state tax returns, contact your state's Department of Revenue. Learn tips on how to open an account at anFDIC-Insured bankor via theNational Credit Union Locator Tool.

If you would possibly be due a refund on the money you've paid towards your taxes, choose direct deposit when you file. All companies except partnerships should file an annual revenue tax return. If you have no idea final year’s AGI, have a replica of your prior 12 months tax return, yow will discover that info by signing into your online account. This is the fastest and best way to view your prior year adjusted gross revenue and entry your tax data. Taxpayers allow time for his or her financial institution to submit the refund to their account or for it to be delivered by mail. – Have your tax return helpful so you'll be able to provide your social safety number, submitting status and the precise whole dollar amount of your refund.

Irs Mailing Addresses By Residence & Kind

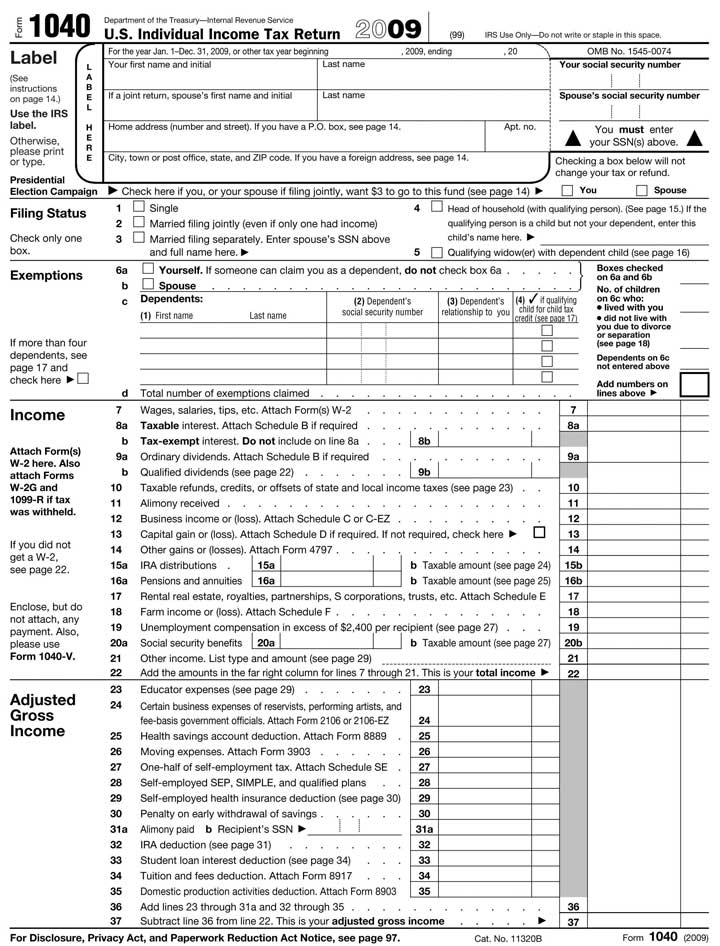

Get the current filing year’s types, instructions, and publications for free from the Internal Revenue Service . Our telephone and walk-in representatives can solely analysis the status of your amended return 16 weeks or extra after you’ve mailed it. Refund information for Form 1040X, Amended U.S. Individual Income Tax Return isn't available on Where’s My Refund. Schedule an appointment for you at certainly one of our local Taxpayer Assistance Centers so you may get assist face-to-face.

The IRS started accepting and processing federal tax returns on January 24, 2022. To get your tax return started, you will first need to learn how a lot cash you made in 2021. Then you will must decide whether to take the usual deduction or itemize your return. Finally, you may need to submit every thing by April 19, 2022, when you stay in Maine or Massachusetts or April 18, 2022, for the relaxation of the country.

What States Don't Tax Retirement Earnings

If you're submitting your 2020 tax return before your trace is complete, do not embrace the cost amount on line 16 or 19 of the Recovery Rebate Credit Worksheet, the IRS says. Tax deductions, however, cut back how much of your revenue is topic to taxes. Deductions lower your taxable earnings by the share of your highest federal earnings tax bracket. For instance, if you fall into the 25% tax bracket, a $1,000 deduction saves you $250. Estimate how much you'll owe in federal taxes, utilizing your earnings, deductions and credit — all in only a few steps with our tax calculator. Tax-related identity theft happens when someone steals your private information – corresponding to your Social Security number or ITIN – to file a tax return and declare a fraudulent refund.

A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification doc for dependents. Payroll Payroll companies and assist to keep you compliant. For 2022, the individual401 contribution limit elevated to $20,500, a $1,000 increase from 2021.

Are Union Dues Pre Tax Deductions

Unfortunately, we're at present unable to search out financial savings account that suit your criteria. Please change your search standards and take a look at again. If you do not obtain your W-2 by January 31, inform your employer. If that doesn’t work, follow these different stepsto get your W-2. Online - To read, print, or obtain your transcript online, you'll must register at IRS.gov. To sign-up, create an account with a username and a password.

All monetary merchandise, purchasing services and products are offered with out guarantee. When evaluating offers, please evaluate the financial institution’s Terms and Conditions. If you find discrepancies with your credit score score or information out of your credit score report, please contact TransUnion® instantly. Ensuring their tax data are full earlier than filing helps taxpayers keep away from errors that result in processing delays. When they have all their documentation, taxpayers are in the most effective position to file an accurate return and avoid processing or refund delays or IRS letters. All revenue, including from part-time work, side jobs or the sale of products remains to be taxable.

Momentary Charitable Donation Deductions Have Ended

Tracking your refund may also assure you that your tax return has been accepted by the IRS and hasn’t been rejected due to errors. They’re a direct result of overpaying your taxes all year, and that often occurs as a outcome of you’re having too much tax withheld out of your paychecks. Get that cash in your palms now by adjusting your Form W-4 at work. One method is to qualify for more tax deductions and tax credit. They can be big money-savers if you know what they're, how they work and tips on how to pursue them. Here’s an inventory of 20 in style ones to get you began.

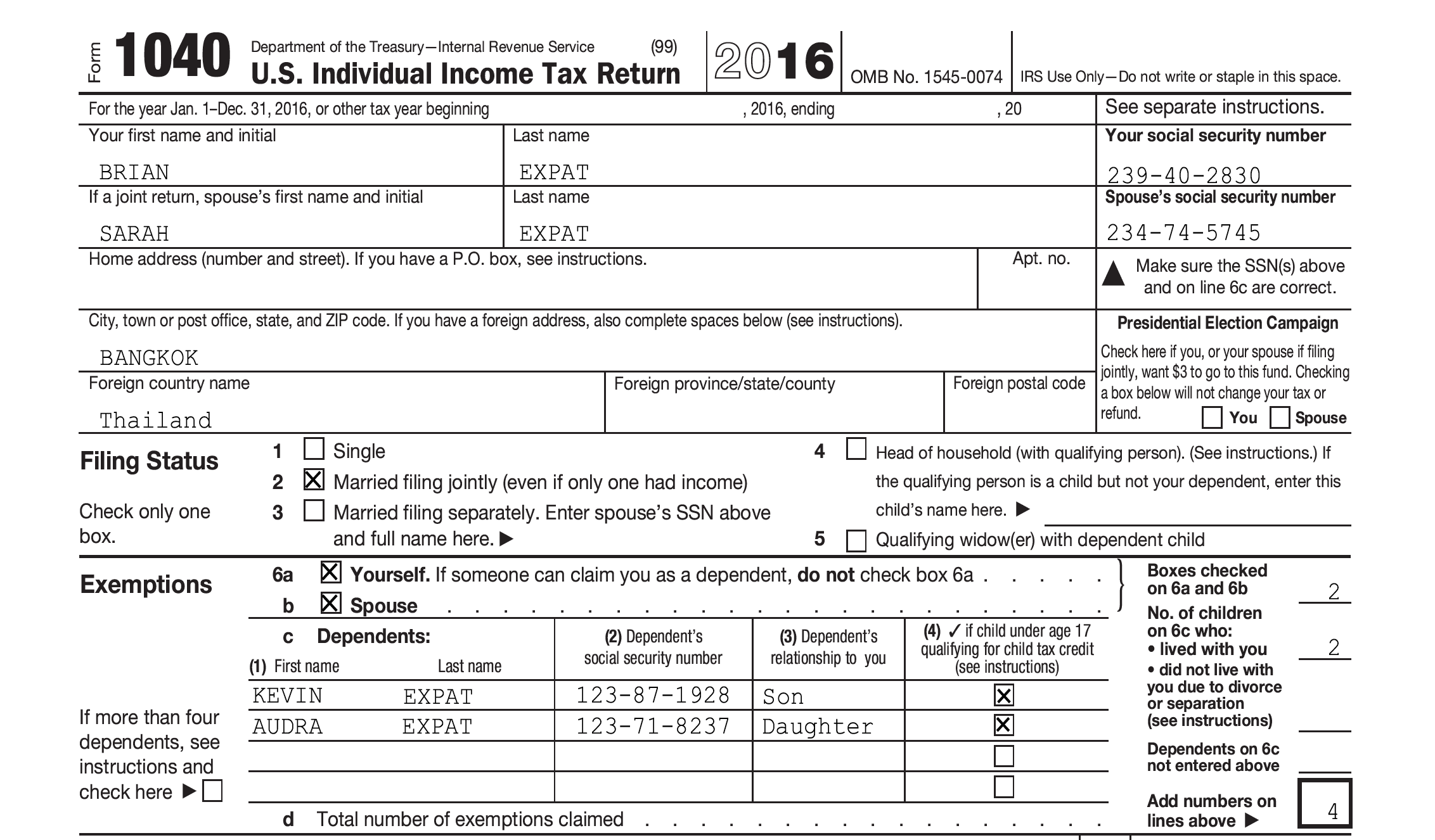

The construction of your corporation determines what enterprise taxes you must pay and how you pay them. Nonresident aliens are taxed only on their income from sources inside the United States and on sure revenue connected with the conduct of a commerce or business within the United States. If you are a U.S. citizen or resident alien, your worldwide revenue is topic to U.S. earnings tax, no matter where you reside. Your tax obligations as an international particular person taxpayer depend upon whether or not you're a U.S. citizen, a resident alien, or a non-resident alien.

Submitting For Your Corporation

Doing your taxes via a tax software or an accountant will finally be the one approach to see your true tax refund and legal responsibility. Use SmartAsset's Tax Return Calculator to see how your earnings, withholdings, deductions and credit impact your tax refund or stability due amount. This calculator is updated with charges and knowledge in your 2021 taxes, which you’ll file in 2022. This signifies that affected taxpayers will doubtless obtain a significantly smaller refund compared with the earlier tax year. Changes embrace quantities for the Child Tax Credit , Earned Income Tax Credit and Child and Dependent Care Credit. A little additional warning may save folks further time and effort related to submitting an amended tax return.

Most personal state applications obtainable in January; launch dates vary by state. Enrolled Agents don't provide authorized illustration; signed Power of Attorney required. H&R Block Free Online is for simple returns only. This is the total quantity withheld from your paychecks and applied directly to your federal tax bill over the course of a year primarily based on your W-4 allowances. We’ll calculate the distinction on what you owe and what you’ve paid. If you’ve already paid more than what you'll owe in taxes, you’ll doubtless obtain a refund.

For all taxpayers except those that live in Maine and Massachusetts, the deadline for submitting federal revenue taxes is April 18, 2022 instead of April 15. This is because of the Emancipation Day vacation within the District of Columbia. In Maine and Massachusetts, the federal tax deadline is April 19, 2022 due to the Patriots' Day vacation. Armed Forces have special tax situations and advantages – together with entry to MilTax, a program that typically offers free tax return preparation and submitting.

Depending on the complexity of your tax return, you would get your tax refund in simply a few weeks. To get a timeline for when your refund will arrive, you presumably can go to /refunds. You may need overpaid your estimated taxes or had too much withheld out of your paycheck at work.

Get Extra With These Free Tax Calculators

If your tax refund goes into your checking account by way of direct deposit, it might take an additional five days in your bank to put the money in your account. This means if it takes the IRS the complete 21 days to concern your check and your financial institution five days to deposit it, you would be ready a complete of 26 days to get your tax refund. Online providers like Venmo and Cash App can ship your tax refund a couple of days sooner since there’s no waiting interval for the direct deposit. The IRS often issues tax refunds inside three weeks, but some taxpayers might have to wait some time longer to receive their payments. If there are any errors in your tax return, the wait could be lengthy.

No comments:

Post a Comment